BISX Lists the GAP Private Fund Ltd.

FOR IMMEDIATE PUBLICATION – MONDAY 8 JANUARY 2018

The Bahamas International Securities Exchange (BISX) is pleased to announce that the Gap Private Fund Ltd. (the Fund) has successfully completed the BISX Mutual Fund Listing Process. As a result, the Fund’s shares have now been added to the roster of funds listed on the Exchange. The Gap Private Fund Ltd. is an open-ended mutual fund.

Gap Private Fund Ltd. is incorporated as an International Business Company under the laws of the Commonwealth of The Bahamas and is licensed as a Smart Fund Model SFM 007 under the Investment Funds Act, 2003.

In speaking of the Listing, Ivan Hooper, Chief Executive Officer of The Winterbotham Trust Company Limited stated: “We are pleased to continue sponsoring the listing of funds under BISX’s, closing the year with the listing of GAP Private Fund Ltd. We look forward to continue listing funds in 2018. As the largest Fund Administrator by number of funds in The Bahamas, listing has become a key component of our offering. Listing with BISX is a key enhancer to this offering and our ability to attract funds to The Bahamas¨.

BISX Chief Executive Officer, Keith Davies, commented on the listing of the Gap Private Fund Ltd. “The Gap Private Fund was approved in late December 2017, we believe that this was an excellent way to close out 2017. Looking forward to 2018 we anticipate more opportunities to work with the Bahamian Financial Services Industry in creating products that are value-additive to their clients and their business. I also want to congratulate Winterbotham for continuing their stellar work in the mutual fund industry.”

The Winterbotham Trust Company Limited served as the BISX Sponsor Member that brought the Gap Private Fund Ltd. to the Exchange. The Winterbotham Trust Company Limited serves as the Administrator of the Fund.

BISX Lists the Artisans of Value Ltd. (SAC) Brick1 Cell Dubai

FOR IMMEDIATE PUBLICATION – Thursday 29, 2017

The Bahamas International Securities Exchange (BISX) is pleased to announce that the Artisans of Value Ltd. (SAC) Brick1 Cell Dubai (the “Fund”) has successfully completed the BISX Mutual Fund Listing Process. As a result, the Fund’s shares have now been added to the roster of funds listed on the Exchange. Artisans of Value Ltd. (SAC) Brick1 Cell Dubai (the “Fund”) is an open-ended mutual fund.

The Fund is incorporated as an International Business Company under the laws of the Commonwealth of The Bahamas and registered as a Segregated Accounts Company as defined in the Segregated Accounts Companies Act, 2004.

BISX Chief Executive Officer, Keith Davies, commented on the listing of the Fund: “We are happy to welcome the first fund listing by Genesis Fund Services onto the Exchange and we are pleased to see financial services providers continuing to see the value in the BISX Mutual Fund Listing Facility. Genesis Fund Services is an innovative Bahamian owned Mutual Fund Administrator and we look forward to working with them in the future and continuing the growth of our mutual fund business.”

CFAL Securities served as the BISX Sponsor Member that brought the Artisans of Value Ltd. (SAC) Brick1 Cell Dubai (the “Fund”) to the Exchange. Genesis Fund Services Ltd. serves as the Administrator of the Fund and Mindful Wealth Pte Ltd. is the Investment Manager. Ansbacher (Bahamas) Ltd. serves as Custodian.

NOTE: Attached to this Press Release is the BISX Formal Trading Notice for Artisans of Value Ltd. (SAC) Brick1 Cell Dubai (the “Fund”). This notice advises the public of the security to be listed on the Exchange and the trading symbol of the listed security.

For Additional Information Contact:

Elude Michel-Sturrup

BISX

Tel: 242-323-2330

Fax: 242-323-2320

Email: info@bisxbahamas.comTrading Notice - AVD

Attachments

BISX Q3 Statistical Report 2017

FOR IMMEDIATE PUBLICATION

JANUARY TO SEPTEMBER 2017 STATISTICAL REPORT

BISX is pleased to announce its BISX All-Share Index and trading statistics for the nine-month period ending September 29, 2017 with comparison to the same period of 2016.

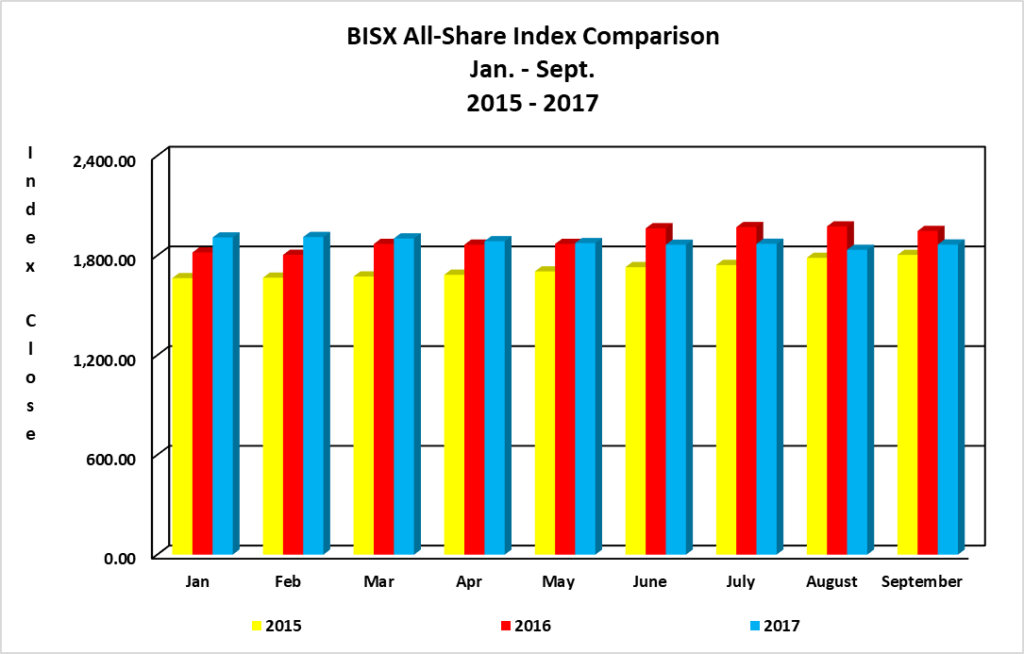

BISX ALL SHARE INDEX

For the nine-month period ending September 29, 2017 the BISX All-Share Index closed at 1,865.88 this represented a year to date decrease of 72.33 or 3.73%. By comparison for the nine-month period ending September 30, 2016 the BISX All-Share Index closed at 1,947.88, this represented a year to date increase of 123.93 or 6.79%. The BISX All-Share Index is a market capitalization weighted index comprised of all primary market listings excluding debt securities.

As at September 29, 2017 the market was comprised of 20 ordinary shares with a market capitalization of $3.944 Billion. In addition, there were 13 preference shares with a market capitalization of $327.25 Million and 19 bonds with a face value of $579 Million.

COMPARISON OF BISX ALL SHARE INDEX TO INTERNATIONAL INDICES

Over the 9-month period January 1 to September 29, 2017, some international equity markets have experienced increases as indicated by the chart below:

| Closing Date | MSCI Emerging Market Index[1] | S&P 500 Index[2] | FTSE 100 Index[3] | BISX All Share Index |

| Dec 30, 2016 |

862.27 |

2,238.83 | 7,142.83 |

1,938.21 |

| Sep 29, 2017 |

1,081.72 |

2,519.36 | 7,372.76 |

1,865.88 |

| % Chg (+/-) |

25.45% |

12.53% | 3.22% |

-3.73% |

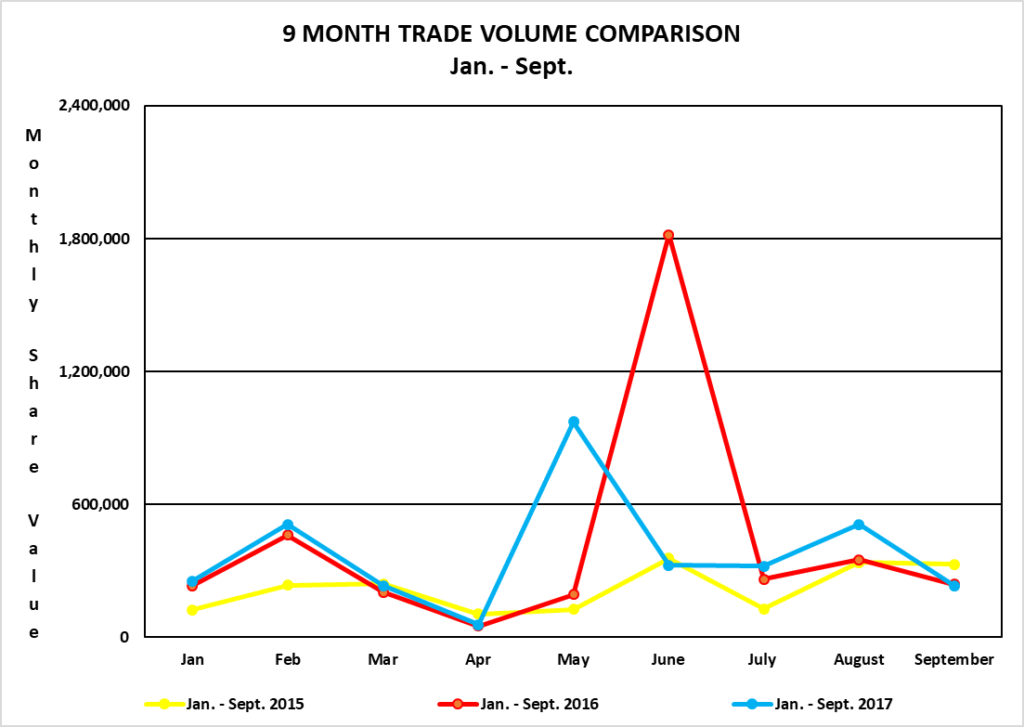

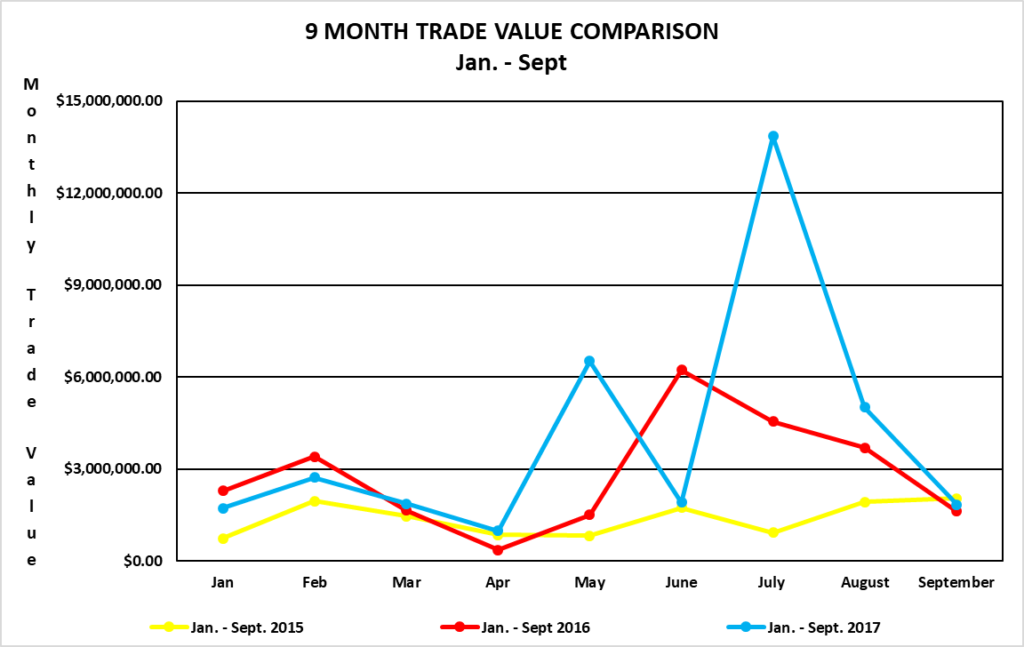

TRADING VOLUMES AND VALUES

Trading volume for the nine-month period January 1, 2017 to September 29, 2017 was 3,414,260 securities for a value of $36,445,020.43. By comparison, trading volume for the nine-month period January 1, 2016 to September 30, 2016 was 3,813,602 securities for a value of $25,321,904.16.

Trading volume for the three-month period July 1, 2017 to September 29, 2017 was 1,063,957 securities for a value of $20,708,119.53. By comparison, trading volume for the three-month period July 1, 2016 to September 30, 2016 was 852,915 securities for a value of $9,871,095.51.

AVERAGE DAILY VOLUME AND VALUE

For the nine-month period from January 1, 2017 to September 29, 2017, the average volume per trading day was 17,811 securities for a value of $193,974.17. By comparison, for the nine-month period from January 1, 2016 to September 30, 2016, the average volume per trading day was 20,240 securities for an average value of $134,582.47.

| Month | Avg. volume / trading day (2017) | Avg. volume / trading day (2016) | Avg. value / trading day (2017) | Avg. value / trading day (2016) |

| January |

12,721 |

11,672 | $86,069.82 |

$114,183.37 |

| February |

25,474 |

21,979 | $135,899.61 |

$162,333.08 |

| March |

10,097 |

9,720 | $81,529.57 |

$78,322.27 |

| April |

3,125 |

2,381 | $54,795.52 |

$17,441.96 |

| May |

42,282 |

9,224 | $283,731.84 |

$72,052.88 |

| June |

16,271 |

86,565 | $95,509.03 |

$296,856.53 |

| July |

16,073 |

12,516 | $692,798.69 |

$216,668.07 |

| August |

23,177 |

16,697 | $228,043.63 |

$176,210.72 |

| September |

11,077 |

11,402 | $87,389.80 |

$77,173.38 |

| Average for period |

17,811 |

20,240 | $193,974.17 |

$134,582.47 |

VOLUME AND VALUE LEADERS (NINE MONTH PERIOD)

The top five volume leaders on BISX for the nine-month period January 1, 2017 to September 29, 2017 with their contribution to total traded volume displayed as a percentage were:

| SYMBOL |

TRADE VOLUME |

% OF VOLUME |

| CHL |

807,589 |

23.9% |

| CBL |

692,113 |

20.5% |

| AML |

632,644 |

18.7% |

| CAB |

398,520 |

11.8% |

| FCL |

290,116 |

8.6% |

The top five value leaders for the nine-month period January 1, 2017 to September 29, 2017 with their contribution to total traded value displayed as a percentage were:

| SYMBOL | TRADE VALUE |

% OF TRADE VALUE |

| CBL | $ 7,132,785.94 |

19.7% |

| BG0407 | $ 7,062,000.00 |

19.5% |

| CHL | $ 4,767,895.72 |

13.2% |

| BG0207 | $ 3,950,000.00 |

10.9% |

| AML | $ 2,757,998.12 |

7.6% |

VOLUME AND VALUE LEADERS (THREE MONTH PERIOD)

The top five volume leaders on BISX for the three-month period July 1, 2017 to September 30, 2017 with their contribution to total traded volume displayed as a percentage were:

| SYMBOL | TRADE VOLUME | % OF VOLUME |

| CBL |

389,860 |

36.6% |

| FCL |

150,321 |

14.1% |

| CAB |

137,387 |

12.9% |

| AML |

107,945 |

10.1% |

| CIB |

77,700 |

7.3% |

The top five value leaders for the three-month period July 1, 2017 to September 30, 2017 with their contribution to total traded value displayed as a percentage were:

| SYMBOL | TRADE VALUE |

% OF TRADE VALUE |

| BG0407 | $ 6,557,000.00 | 31.7% |

| CBL | $ 3,959,175.46 |

19.1% |

| BG0207 | $ 3,950,000.00 |

19.1% |

| FCL | $ 1,265,587.75 | 6.1% |

| BG0105 | $ 1,200,000.00 |

5.8% |

BISX Speaks to BBCC Business Class

FOR IMMEDIATE PUBLICATION – 14 November 2017

BISX CHIEF OPERATING OFFICER SPEAKS TO BAHAMAS BAPTIST COMMUNITY COLLEGE (BBCC) BUSINESS CLASS

Mr. Holland Grant, the Chief Operating Officer (COO) of BISX, was invited to speak to students of a Business Math Class at the Bahamas Baptist Community College (BBCC) on Monday, November 6, 2017. Commenting on the opportunity, Mr. Grant noted, “It is always a pleasure to share knowledge to the future generations on investing and how the stock market works. In fact, it is important that we teach young people about investments so that they can be more motivated to invest. The information that I shared is intended to be foundational and to form a basis for the students to build upon. I hope that discussions such as these help the country to transform into an investing society.”

Mr. Holland Grant and Mr. Davis with the students of BBCC

One of the students from BBCC, Antonia Moss noted: “The lecture from Mr. Grant has made me more knowledgeable about the stock exchange business. He made us aware of the various functions performed by the Exchange and the companies traded over BISX. In addition, he also mentioned to us briefly about stocks and bonds and how they are utilized by businesses along with their benefits. Mr. Grant has opened my eyes to reality in reference to regulations such as Exchange Controls. This showed me that we should invest more in our own people rather than allowing others to dictate to us. Therefore, it proves to us that we should have a more goal oriented mindset to improve ourselves in the business world”.

Another student, Ms. Kendra Carey, explained that “Mr. Grant lecturer on BISX was well organized and presented to our Business Math class. He has made what I thought to be a difficult topic very understandable. Clearly he enjoys the topic and has lots of information on it. The presentation was great and he paid attention to the students, and as such not just lecturing, but actually engaging the class. It was a great introduction to the Bahamas International Securities Exchange. Finally I am able to make sense of the BISX Market Report that I see in newspaper. He had also included examples for other regional stock markets, like the Jamaica Stock exchange and its Junior Markets. I have learned so much and Mr. Grant communicated the subject matter very clearly. Out of all my courses this has been the one surely peaked my interest. Thank you for the knowledge you have bestowed with us today”.

From left to right, Mr. Colin Davies and Mr. Holland Grant

Mr. Colin Davis, the lecturer from BBCC, expressed his gratitude by saying ” We in the Business Division at Bahamas Baptist Community College always try to merge academic theory with the business environment. BISX through Mr. Grant continues to assist us in this regard with his guest lectures at our institution. These discussions open up the student to the operations of the local stock exchange and bring a new, fresh and creative angle to what would have only been read in a text book or on-line. Because of the vast knowledge Mr. Grant brings to the subject area, our students show vast improvement after his lectures, not only on BISX, but also in the general business environment. We thank BISX in general and Mr. Grant in particular, for their continuing relationship with our institution.”

Attachments

- « Previous Page

- 1

- …

- 10

- 11

- 12

- 13

- 14

- …

- 25

- Next Page »